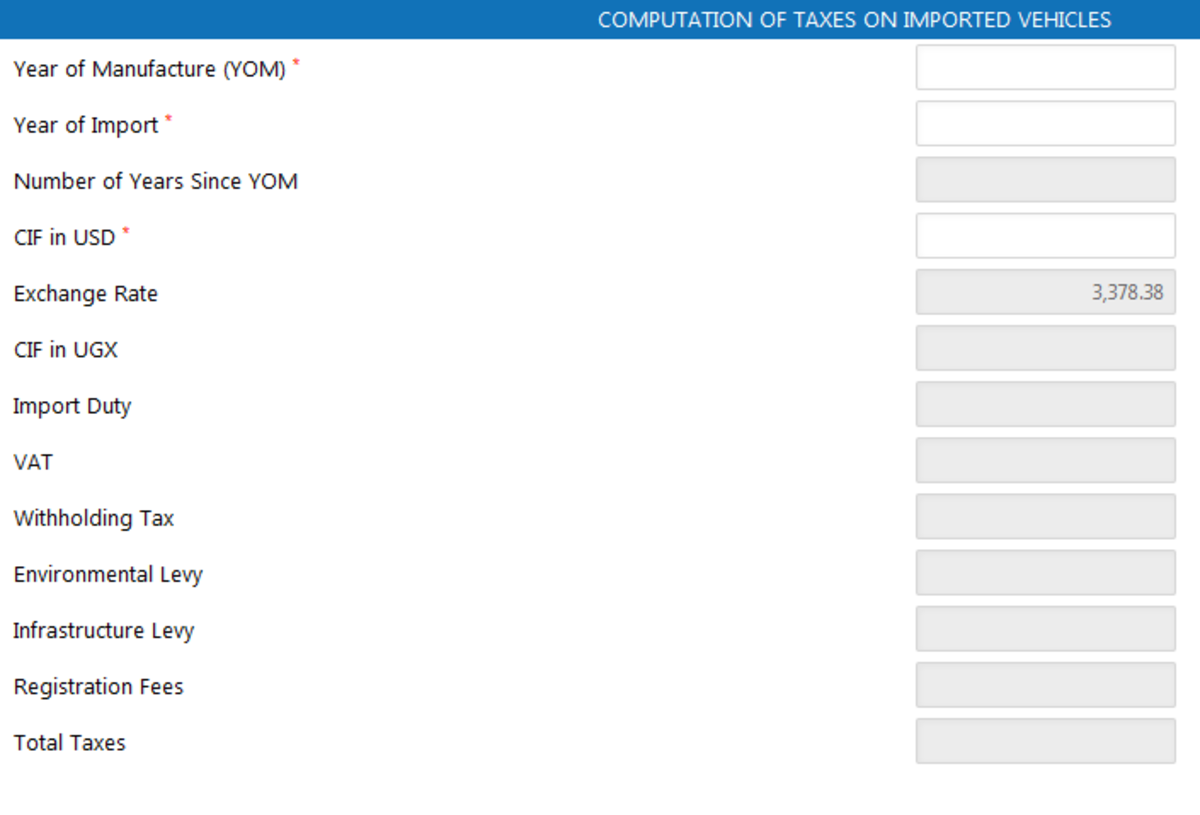

Uganda Revenue Authority - URA. Vehicle Type * Select One; AMBULANCE . Calculate: Clear: Please note that this calculation gives indicative values. The value may vary at the time of import . WithHolding Tax (6%) 0.0 0.0 0.0 Infrastructure Levy 0.0 Stamp Duty 0.0 Form Fees .. MOTOKA UG:Vehicle Import Taxes in Uganda made easy!! ura vehicle tax calculator. Quick Advanced Vehicle import taxes for Uganda are no longer a mystery!! Welcome to Motoka UG Easy to use online calculator Immediate Results!! Based on make, model and year of car Official URA Valuations and Taxes Official URA Exchange Rate For Developers Embeddable widget Motoka UG API Contact us at [email protected] For Car Dealers ura vehicle tax calculator. Compute Motor Vehicle Import Tax - Uganda Revenue Authority. Tax Calculators Compute Motor Vehicle Import Tax UGANDA REVENUE AUTHORITY Motor Vehicle Calculator Vehicle Type* UNSUPPORTED VEHICLE Applicable Currency* CIF Value* Seating Capacity* Gross weight in Kgs* Engine Capacity (CC)* Year Of Manufacture* Select One State (For motocycles only) Select One Calculate Clear. Tax Calculators - Uganda Revenue Authority. Tax Calculators Back PAYE Rental Tax for Individuals Advance Motor Vehicle Tax Gross Income Resident Status Calculate Add to Bookmarks (0) How do you find this resource? Share Contact Us. Motor vehicle Value Guide - Uganda Revenue Authority. IT-Digital Service Tax Return Form for Non-Resident Service Providers; Document Authentication; DTS. Motor Vehicle or Stamp Duty or Driving Permit; Import or Export Tax Refund; . Uganda Revenue Authority Headquarters, Plot M193/M194, Nakawa Industrial Area P ura vehicle tax calculator. O. Box 7279, Kampala. ura vehicle tax calculator. Uganda Revenue Authority

Ura vehicle tax calculator

bábes bolyai tudományegyetem kolozsvár felveteli eredmenyek 2018

Uganda Revenue Authority - URA. Vehicle Type * Select One; AMBULANCE . Calculate: Clear: Please note that this calculation gives indicative values. The value may vary at the time of import . WithHolding Tax (6%) 0.0 0.0 0.0 Infrastructure Levy 0.0 Stamp Duty 0.0 Form Fees .. MOTOKA UG:Vehicle Import Taxes in Uganda made easy!! ura vehicle tax calculator. Quick Advanced Vehicle import taxes for Uganda are no longer a mystery!! Welcome to Motoka UG Easy to use online calculator Immediate Results!! Based on make, model and year of car Official URA Valuations and Taxes Official URA Exchange Rate For Developers Embeddable widget Motoka UG API Contact us at [email protected] For Car Dealers ura vehicle tax calculator. Compute Motor Vehicle Import Tax - Uganda Revenue Authority. Tax Calculators Compute Motor Vehicle Import Tax UGANDA REVENUE AUTHORITY Motor Vehicle Calculator Vehicle Type* UNSUPPORTED VEHICLE Applicable Currency* CIF Value* Seating Capacity* Gross weight in Kgs* Engine Capacity (CC)* Year Of Manufacture* Select One State (For motocycles only) Select One Calculate Clear. Tax Calculators - Uganda Revenue Authority. Tax Calculators Back PAYE Rental Tax for Individuals Advance Motor Vehicle Tax Gross Income Resident Status Calculate Add to Bookmarks (0) How do you find this resource? Share Contact Us. Motor vehicle Value Guide - Uganda Revenue Authority. IT-Digital Service Tax Return Form for Non-Resident Service Providers; Document Authentication; DTS. Motor Vehicle or Stamp Duty or Driving Permit; Import or Export Tax Refund; . Uganda Revenue Authority Headquarters, Plot M193/M194, Nakawa Industrial Area P ura vehicle tax calculator. O. Box 7279, Kampala. ura vehicle tax calculator. Uganda Revenue Authority

nomination bileklik

. Easily calculate your Tax obligations to URA using the new Tax Calc. Motor Vehicle Tax Calculator Verify Advance Income Tax Payment Document Authentication: Compliance Always fulfil your tax obligations and report any non-compliance. Report Non-Compliance:. How to Calculate Taxes on Cars (Used or New) in Uganda - Ug Tech Mag. Fortunately, the Uganda Revenue Authority (URA) offers an online car tax calculator that can help you estimate the taxes you may have to pay on a specific vehicle. In this guide, we will walk you through the steps of using the URA car tax calculator so that you can make informed decisions when buying a used or brand-new car in Uganda.. 3 URA Vehicle Tax Calculators To Use | Thekonsulthub.com. Using a URA motor vehicle tax calculator is vital when it comes to helping one make an estimate of the exact amount of taxes they are liable to pay. Whether you are planning to import a used or brand new motor car, using either of the 3 motor vehicle tax calculators will help you get a figure on what URA will likely charge you.. How To Calculate Motor Vehicle Tax In Uganda - 2023/2024. 1. Firstly, select the car model and make. To begin the computation, choose a vehicle model and make. It is important to note that most dealers and auction houses display the FOB. Hence, you need to add the FOB to other additional costs like taxes, insurance and shipping fees to get the total value of the vehicle. 2 ura vehicle tax calculator. Collect data on the vehicle.. Customs Valuation - The Taxman - URA ura vehicle tax calculator. This is the value of imported goods for the purposes of levying/calculating ad valorem Customs duties and taxes. x For Goods imported using road rail and marine transport modes, the customs value is a composed of the Price actually paid or payable for the goods, cost of insurance and freight. ura vehicle tax calculator. URA Tax Calculator: PAYE, VAT, - Apps on Google Play. URA Tax Calculator enables you to calculate the various taxes levied by the Uganda Revenue Authority so that you can be prepared to file your tax returns. The tax calculator.. How to Calculate Taxes on Cars (Used or brand New) in Uganda. Fortunately, the Uganda Revenue Authority (URA) offers an online car tax calculator that can help you estimate the taxes you. Taxes to URA during car importing - Ask Your Government Uganda. Thank you Charles for writing to URA, Kindly visit ura.go.ug then click on Tax tools and after click Motor Vehicle Calculator .Please input your car details and you will be an estimate of the taxes for your car. ura vehicle tax calculator. How to Calculate Uganda Revenue Authority Car Taxes - Expert .. How until Calculate Uganda Revenue Authority Car Taxes 2021-11-26 2017-07-11 for Carusedjp. Last Revised on 11月 26, 2021 by CarusedjpCarusedjp ura vehicle tax calculator. 301 Moved Permanently ura vehicle tax calculator. Apache/2.4.52 (Ubuntu) Server at carused.jp Port 80. How to Calculate Uganda Revenue Authority Car Taxes - Expert .. How to Estimate Uganda Revenue Authority Car Taxes 2021-11-26 2017-07-11 by Carusedjp 2017-07-11 by Carusedjp. Import Duty Calculator | Free Customs Duty Calculator UK - Wise. 3. Tax will be due on the cost of the goods and shipping, which in this case is £22,000 (£15,000 + £7,000). 4. 4.5% of £22,000 is £990 (22,000 0,045) ura vehicle tax calculator. So for the goods, shipping, and import duty, youll pay £22,990 in total. As its from outside the EU, youll also need to pay VAT on this amount.. The Salary Calculator - Take-Home tax calculator ura vehicle tax calculator. The Salary Calculator tells you monthly take-home, or annual earnings, considering UK Tax, National Insurance and Student Loan. The latest budget information from April 2023 is used to show you exactly what you need to know. Hourly rates, weekly pay and bonuses are also catered for.. Estimate your Income Tax for the current year - GOV.UK. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (6 April 2023 to 5 April 2024). This tells you your take-home pay if you do not have .. Route planner: route calculation, detailed journey cost - ViaMichelin. ViaMichelin can provide a detailed journey cost for any car or motorcycle route: fuel cost (with details on fuel costs for motorways and other roads) and toll costs (information for each toll used). If you have entered your vehicle model, the cost will be calculated according to its consumption levels. ViaMichelin also enables you to spread the .. Tax Calculator - Uganda Revenue Authority ura vehicle tax calculator

al insyiqaq latin

. Contact Us. Toll Free: 0800 117 000 / 0800 217 000 ura vehicle tax calculator. Help: Click here for HELP/SUPPORT. Report Tax Evasion: +256 (0)323442055. Email: [email protected] ura vehicle tax calculator. WhatsApp: 0772140000. Headquarters Address: Show

harga tandan sawit terkini 2022

. Uganda Revenue Authority Headquarters, Plot M193/M194, Nakawa Industrial Area.. Home - Uganda Revenue Authority ura vehicle tax calculator. Contact Us. Toll Free: 0800 117 000 / 0800 217 000. Help: Click here for HELP/SUPPORT. Report Tax Evasion: +256 (0)323442055 ura vehicle tax calculator. Email: [email protected]. WhatsApp: 0772140000. Headquarters Address: Show. Uganda Revenue Authority Headquarters, Plot M193/M194, Nakawa Industrial Area.. Uganda Revenue Authority on Twitter: "As you import a motor vehicle .. As you import a motor vehicle/cycle, kindly use the 𝐌𝐨𝐭𝐨𝐫 𝐕𝐞𝐡𝐢𝐜𝐥𝐞 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐨𝐫 on our webportal through this link-> bit.ly/Motor-Vehicle-Calculator … 𝐊𝐢𝐧𝐝𝐥𝐲 𝐍𝐨𝐭𝐞: This calculation gives indicative values which may vary at the time of import. ura vehicle tax calculator. CAR TAXES: URA to Issue Statement as Court Ruling Bites

πως λειτουργει το wetransfer

. One of the car importers said they had lost billions of shillings in unlawful taxes. "If you wish to buy yourself a 2022 Toyota Land Cruiser TX (TRJ150), it will cost you about $34,508 to CIF (cost, insurance, and freight) Mombasa or less where your tax obligation will be Shs 73,723,402," said an experienced car importer who preferred anonymity to speak freely.. Why you pay more taxes on newer used cars | Monitor ura vehicle tax calculator. Tax calculator URA has an electronic tax calculator where the buyer feeds in the year in which a vehicle was manufactured, the cost of the vehicle (CIF), the year of importation and then total . ura vehicle tax calculator. PDF Taxation Handbook - Ura. tax system from tax policy issues, international trade and customs and domestic taxes, recent tax amendments, examples from the small business taxpayers, employment, and multinational operations that answer all of. Uganda Revenue Authority. Easily calculate your Tax obligations to URA using the new Tax Calc. Motor Vehicle Tax Calculator Verify Advance Income Tax Payment Document Authentication: Compliance Always fulfil your tax obligations and report any non-compliance. Report Non-Compliance:. Motor Vehicle Import Duty - KRA. Individual /. Calculate Tax /. Get the Right Figure / ura vehicle tax calculator. Motor Vehicle Import Duty. Pay As You Earn (PAYE) Motor Vehicle Import Duty. Motor Cycle Import Duty. VAT Calculator.. Used Motor Vehicle Valuation System - Used Motor Vehicle Valuation System. Select Vehicle Details below to Calculate Value. Make ura vehicle tax calculator. Model & Body. Year Of Manufacture. Country of Origin ura vehicle tax calculator. Fuel Type. Engine. Side by Side Used Motor Vehicle Value Comparison ura vehicle tax calculator. Use TRA vehicle reference code (if known). Ministry of Works to Fully Handle Motor Vehicle Registration. With effect from 1st July 2023, all vehicle registration functions will be handled by the Ministry of Works and Transport (MoWT) ura vehicle tax calculator. This move is the final stage in the transition of Vehicle registration from URA to MoWT that commenced three years ago. The transition was managed in phases, with the first phase including post-registration services .. UshuruCalc.co - The most reliable KRA M/V duty calculator

tuia de vanzare

. Vehicle Make. Vehicle Model

ce poti deveni cu facultatea de drept

. Complete Import Tax and Regulations for used cars in Uganda (2019 .. Car Import Taxation and Charges in ura vehicle tax calculator. The custom duty value of imported cars in Uganda is calculated using the General Agreement on Trade and Tariffs (G.A.T.T) valuation method. As a guide, information on the taxation or tariff on importing used vehicles in Uganda is as follows: 15% of dutiable value. 17% of VAT value.. Vehicle tax rates: Cars registered on or after 1 April 2017 - GOV.UK. Alternative. £560. £560. £588. £308 ura vehicle tax calculator. £294. Next Cars registered between 1 March 2001 and 31 March 2017. View a printable version of the whole guide. Tables showing the rates for vehicle tax . ura vehicle tax calculator. How To Calculate Car Taxes In Uganda - 2023/2024 ura vehicle tax calculator. The rates are split into different bands the lower the emissions, the lower the vehicle tax. In order to tax a vehicle, suitable insurance cover must be in place, while the car must also have a valid MOT. How To Calculate Car Taxes In Uganda. Import duty - Usually 15% of dutiable value ura vehicle tax calculator. Value added tax - (VAT) is 17% of the import duty fees.. PAYE Calculator - Uganda Revenue Authority. PAYE Calculator - Uganda Revenue Authority. Customs Audits and Refunds ura vehicle tax calculator. [email protected]. WhatsApp: 0772140000. The Uganda Electronic Single Window. ura vehicle tax calculator. Import Cars | Calculate your taxes before importing to Uganda. With Import Cars you can calculate your taxes and other costs involved before, during and after the process of importing a car into Uganda.. CAR TAXES: URA to Issue Statement as Court Ruling Bites. Uganda Revenue Authority (URA) has enunciated it will provide consultation to car importers after a court ruled that the authoritys method of estimating car taxes was unlawful. "We are evaluating the implications of the ruling on our customs processes and will advise importers accordingly," URA spokesperson Ibrahim Bbosa told ChimpReports on Saturday night. ura vehicle tax calculator. Uganda Revenue Authority. Easily calculate your Tax obligations to URA using the new Tax Calc. Motor Vehicle Tax Calculator Verify Advance Income Tax Payment Document Authentication: Compliance Always fulfil your tax obligations and report any non-compliance. Report Non-Compliance:. Free Duties and Taxes Calculator Uganda | Easyship. The Tax Free Threshold Is 50 USD. If the full value of your items is over 50 USD, the import tax on a shipment will be 18%. For example, if the declared value of your items is 50 USD, in order for the recipient to receive a package, an additional amount of 9.00 USD in taxes will be required to be paid to the destination countries government.. Car Sales Tax Calculator | New and Used Car Sales Tax in USA. If you buy a new car for $10000 with a 5% sales tax rate, you pay $500 sales tax while purchasing. If you buy a used car from a personal seller, you may not pay sales tax. But if you purchase a used car from a dealership, you should pay sales tax on the total purchase price like a new car.. Uganda Revenue Authority ura vehicle tax calculator. icea general insurance co ltd v ura tat no. 100 of 2019; independent publications limited vs. ura tat no ura vehicle tax calculator. 55 of 2018; infectious diseases institute vs ura tat appn 15 of 2019; kansai plascon uganda limited vs ura tat no 64 of 2020; nokia solutions network branch operations oy vs ura tat 80 of 2020; palladium group u ltd vs ura tat application .. URA tax calculations encourage buying old cars | Monitor. URA tax calculations encourage buying old cars Wednesday, May 25, 2016 — updated on January 01, 2021 ura vehicle tax calculator. The main reason in my view is the taxation structure as evidenced by the motor vehicle .. What new taxes mean for Uganda | Monitor. Waiver of interest and penalties on tax outstanding by June 30 The Tax Procedures (Amendment) Bill, 2023, is proposing to grant the URA power to waive interest and penalties to taxpayers that .. Uganda Revenue Authority. Easily calculate your Tax obligations to URA using the new Tax Calc. Motor Vehicle Tax Calculator Verify Advance Income Tax Payment Document Authentication: Compliance Always fulfil your tax obligations and report any non-compliance. Report Non-Compliance:. URA introduces new system to easily collect taxes from imported used .. Uganda Revenue Authority-URA is finding it difficult to collect up to Shillings 172 billion from used vehicles in bonded warehouses using the current tax administration system. According to the current system, all imported vehicles are required to pay taxes in a period not exceeding 9 months from the time of importation. ura vehicle tax calculator. PDF Withholding Tax - Ura. The Tax policy changes for fiscal year 2018/2019 introduced ten percent Withholding tax on commission given to mobile money dealers ura vehicle tax calculator. It is a final tax. l. Witholding tax on commissions to insurance and advertising agents The Tax policy changes for the FY 2020/2021 increased the withholding tax. CAR TAXES: URA to Issue Statement like Court Ruling Bytes. Uganda Revenue Authority (URA) has said it will provide advice to car importers after a place ruled that the authoritys method of estimating car taxes was unlawful. "We what evaluating the repercussions of the ruling on our custom processes and will advise importers accordingly," URA spokesperson Ibrahim Bbosa told ChimpReports on Saturday night.. Uganda Revenue Authority - ura.go.ug ura vehicle tax calculator. icea general insurance co ltd v ura tat no. 100 of 2019; independent publications limited vs ura vehicle tax calculator. ura tat no. 55 of 2018; infectious diseases institute vs ura tat appn 15 of 2019; kansai plascon uganda limited vs ura tat no 64 of 2020; nokia solutions network branch operations oy vs ura tat 80 of 2020; palladium group u ltd vs ura tat application .. URA. URA. How to Calculate Uganda Revenue Authority Car Taxes - Expert .. Method to Calculate Uganda Revenue Authority Car Taxes 2021-11-26 2017-07-11 by Carusedjp 2017-07-11 by Carusedjp. How to Create Account - Ura. Tax Assiss. ee ogin ssistance ura vehicle tax calculator. Have Portal Account? Request Passcode Taxpayers Details Forgot Login Information Create Account Form For Member Login Login (d Individual 01/06/2013 KANJOKYA KAMWOKYA NAKAWA DIVISION KAMWOKYA josephinem ugenyi©gmail. con 8YA8AGYE r Password est! Close Panel A-Z Tax Topics More. Motor Vehicle Tax Calculator. TRA Vehicle tax calculator Tanzania 2022 | TRA Calculator 2022 - Used .. TRA Vehicle tax calculator Tanzania 2022 | TRA Calculator 2022 - Used Motor Vehicle Valuation System TRA The Tanzania Revenue Authority (TRA) is a government agency of Tanzania, charged with the responsibility of managing the assessment, collection and accounting of all central government revenue. It is a semi-autonomous body that operates in .. Uganda Revenue Authority. 2019 Oct-Dec ura vehicle tax calculator. 2018 April-June. Archive. Press Brief. FY/2022/23 Quarter 1 Revenue Performance ura vehicle tax calculator. FY2021/22 Qtr1 Revenue Performance. FY2020/21: Annual Performance & URA at 30 years Launch- English. FY2020/21: Annual Performance & URA at 30 years Launch- Luganda. FY2020/21: Qtr1 Performance & TPAS Launch. ura vehicle tax calculator. Car allowance calculator for the 2021 tax year. - YourTax. 2021 Car Allowance Calculator. 01 March 2020 - 28 February 2021. Car value. Logbook. Total KM. Business KM. Actual Expenses. Calculate. A car allowance calculator for the 2021 tax year that calculates your claim based on the fixed cost method provided by SARS. ura vehicle tax calculator. URA Tax Calculator: PAYE, VAT, APK (Android App) - Free Download - APKCombo. URA Tax Calculator enables you to calculate the various taxes levied by the Uganda Revenue Authority so that you can be prepared to file your tax returns. The tax calculator incorporates a PAYE Calculator, a VAT Calculator, a Stamp Duty Calculator, a Withholding Tax Calculator, among others. With an in-built calculator🖩, you can perform your . ura vehicle tax calculator. Uganda Revenue Authority. Easily calculate your Tax obligations to URA using the new Tax Calc. Motor Vehicle Tax Calculator Verify Advance Income Tax Payment Document Authentication: Compliance Always fulfil your tax obligations and report any non-compliance ura vehicle tax calculator. Report Non-Compliance:. Canada Vehicle Tax Calculator. Vehicle Tax Calculator. This is a free tool to help estimate the provincial/territorial and federal taxes owing on vehicle transactions in any Canadian province including Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Nunavut, Ontario, Prince Edward Island, Quebec, and Yukon.. Uganda Revenue Authority - URA. ignite@ura; Lumping of VAT Sales; Cancellation of VAT Registration; Approved Tax Agents; 2018 WHT exemptions; Integrity; Rental Tax; Tax Agents Registration; Bonded Warehouse Licence; Public Auction; TIN for employees; Income Tax reminder; . Witholding Tax Agents 2018/19; Customs Agency Licence 2019; ura vehicle tax calculator. URA wrong not to use value of used cars in determining taxes, court . ura vehicle tax calculator. URA wrong not to use value of used cars in determining taxes, court rules ura vehicle tax calculator. Thursday, April 13, 2023. An importer of used vehicles took URA to court challenging the method it had used to arrive at . ura vehicle tax calculator. How to Apply for Alteration of Particular on a Motor Vehicle In Uganda. Uganda tax authority (URA) Fees. Item : Fields that can be altered Cost: UGX 20,000. Item : Modification in vans configuration to PSV Cost: UGX 172,000. The item : Form Fees Cost: UGX 12,000 ura vehicle tax calculator. The item is : Fees for inspection for motor vehicles and dual-purpose vehicle Cost: UGX 12,000. Items : Inspection fees for motor vehicles other than . ura vehicle tax calculator. How To Calculate CIF In Uganda - 2023/2024. How Much Tax Do You Pay For A Car In Uganda? Car Import Taxation and Charges in Uganda Import Duty: 15% of dutiable value. VAT: 17% of VAT value. Import Commission: 2% of Dutiable Value. Withholding Tax: 4% of Dutiable Value

si ti heqim lythat gjenital

. How Much Is Customs Duty In Uganda? Most finished products are subject to a 25% duty, while intermediate products face a .. Tanzania Revenue Authority - Calculators & tools ura vehicle tax calculator. The launching of Longido Clean Water Project in Arusha. This project has been facilitated by taxpayers through tax payments. Construction of Tanzanite Bridge in Dar es Salaam is one of the tax benefits. Pay tax to build our Nation. Payment of taxes facilitates construction of various infrastructures such as 107.4 km Njombe - Makete road.. Motor Vehicle - Guyana Revenue Authority. The formulae used to calculate the taxes on a vehicle four years and older is as follows: (CIF + Excise) * 30% + Excise ura vehicle tax calculator

. MOTOKA UG:Vehicle Import Taxes in Uganda made easy!!. MOTOKA UG provides an easy to use online calculator of vehicle import taxes for Uganda using official Uganda Revenue Authority valuations ura vehicle tax calculator. MOTOKA UG: . Motoka UG was established in 2015 to provide a quick and accessible way to calculate your vehicles import tax obligations to Uganda ura vehicle tax calculator. Motoka UG receives over 2500 visitors to its website ..